1Article World - Free Article Submission For Authors, Free Content for Publishers!

Read More About Forex Trading Currency

When you trade in the forex exchange, you’re playing with stocks and currency from other countries and corresponding forms of products. One nation’s currency is set against the same in a different foreign market to decide the overall value. The entire value is calculated in forex exchange trades. Many foreign markets will have control over the total worth of their country with regards to monies. People who are frequently engaged in the market exchange for FX involves banks, businesses goveWhat kinds of variables make forex stock markets so different from the US stock market? A forex market trade is one between two countries, and it can take place worldwide. Each country involved should be either 1, that of the investor, and 2, the place receiving the investment. Most all of the transactions that take place in the forex markets will be qualified through an experienced broker such as a bank.

What are the ingredients of the forex stock exchange? The forex stock exchange is made up of a variety of transactions and countries. Investors in the forex stock market tend to trade in boastfully large volumes and huge amounts of money. Those deeply imbedded in the forex exchange are generally involved in cash businesses or in the trade of very liquid assets that you can sell and buy fast. The market is large, very large and it would not be wrong to imagine the forex stock market as even more immense than any given single stock market. Forex traders 365 days per year, twenty-four hours a day and most of the time on week-ends.

You might be surprised at the great number of investors that are involved in forex trading. In 2004 alone, as high as two trillion in money was the median forex exchange trading volume. This is an immense number of trades with regards to the amount of daily transactions to take place. Think about how much a trillion dollars really is then double that, and this amount is the average that is traded on any given day on the forex exchange!

The forex exchange has been around for thirty years, but with computers coming into play and then the internet, the trading on the forex market continues to grow as more and more people and businesses alike start to understand the power of the forex market. The forex exchange accounts for only 10% of the sum of all trades between two countries but with greater popularity will come a greater volume.rnments and other financial firms.

What are the ingredients of the forex stock exchange? The forex stock exchange is made up of a variety of transactions and countries. Investors in the forex stock market tend to trade in boastfully large volumes and huge amounts of money. Those deeply imbedded in the forex exchange are generally involved in cash businesses or in the trade of very liquid assets that you can sell and buy fast. The market is large, very large and it would not be wrong to imagine the forex stock market as even more immense than any given single stock market. Forex traders 365 days per year, twenty-four hours a day and most of the time on week-ends.

You might be surprised at the great number of investors that are involved in forex trading. In 2004 alone, as high as two trillion in money was the median forex exchange trading volume. This is an immense number of trades with regards to the amount of daily transactions to take place. Think about how much a trillion dollars really is then double that, and this amount is the average that is traded on any given day on the forex exchange!

The forex exchange has been around for thirty years, but with computers coming into play and then the internet, the trading on the forex market continues to grow as more and more people and businesses alike start to understand the power of the forex market. The forex exchange accounts for only 10% of the sum of all trades between two countries but with greater popularity will come a greater volume.rnments and other financial firms.

Online Forex Trading Tips

Online Forex Trading Tips

Posted by admin on Jun 19th, 2009 no comments

The faceless and trust based forum that the Internet facilitates is in no way a hindrance to trade in foreign currencies. Online forex trading involves currency trading that is facilitated and transacted through dedicated Internet links during the designed forex market hours…

What is forex trading?

Forex trading involves the buying and selling of foreign currencies. The term has been derived from foreign - ‘for’ and exchange - ‘ex’. It is almost like stock trading in the stock market where the foreign currencies take on the role of shares of currency institutions of the countries traded with. In forex capital markets, the stock investing follows the demands of value, economy and time. The volatility of currency exchange trading comes from the possibility to buy a currency low and subsequently sell short ‘high currency’. This online job rostrum needs the application of meticulous pursuit of the various exchange rates. Forex online currency trading demands that investors scrutinize the trajectory pair-wise, via internet marketing strategies.

Posted by admin on Jun 19th, 2009 no comments

The faceless and trust based forum that the Internet facilitates is in no way a hindrance to trade in foreign currencies. Online forex trading involves currency trading that is facilitated and transacted through dedicated Internet links during the designed forex market hours…

What is forex trading?

Forex trading involves the buying and selling of foreign currencies. The term has been derived from foreign - ‘for’ and exchange - ‘ex’. It is almost like stock trading in the stock market where the foreign currencies take on the role of shares of currency institutions of the countries traded with. In forex capital markets, the stock investing follows the demands of value, economy and time. The volatility of currency exchange trading comes from the possibility to buy a currency low and subsequently sell short ‘high currency’. This online job rostrum needs the application of meticulous pursuit of the various exchange rates. Forex online currency trading demands that investors scrutinize the trajectory pair-wise, via internet marketing strategies.

The Optimal Engine for Currency Trading

As traditional inter-bank, over-the-counter phone trading gives way to a transparent, efficient global Forex market, Fortex is paving the way to electronic foreign exchange trading with Fortex FX. Fortex FX unifies execution venues across the globe and aggregates segmented liquidity pools to provide Forex traders with real-time quotes and execution capabilities. The platform’s unique artificial intelligence (AI) engine delivers Straight-Through Processing (STP) without human intervention—speeding execution, enabling 24x7x365 trading, and reducing execution costs. A highly intuitive interface supports the most sophisticated currency trading strategies and analysis to keep you in front of moving markets.

Now you can bypass traditional published pricing and preferential quotes-on-request. With the world’s largest financial market trading over US$1 trillion per day, Fortex FX levels the playing field for currency trading, providing you with direct, transparent access and real-time executi

Now you can bypass traditional published pricing and preferential quotes-on-request. With the world’s largest financial market trading over US$1 trillion per day, Fortex FX levels the playing field for currency trading, providing you with direct, transparent access and real-time executi

Welcome To Forex Explained

FOREX (Foreign Exchange Market) The foreign exchange market is also known as FX or it is also found to be referred to as the FOREX. All three of these have the same meaning, which is the trade of trading between different companies, banks, businesses, and governments that are located in different countries. The financial market is one that is always changing leaving transactions required to be completed through brokers, and banks. Many scams have been emerging in the FOREX business, as foreign companies and people are setting up online to take advantage of people who don't realize that foreign trade must take place through a broker or a company with direct participation involved in foreign exchanges. Cash, stocks, and currency is traded through the foreign exchange markets. The FOREX market will be present and exist when one currency is traded for another. Think about a trip you may take to a foreign country. Where are you going to be able to 'trade your money' for the value of the money that is in that other country? This is FOREX trading basis, and it is not available in all banks, and it is not available in all financial centers. FOREX is a specialized trading circumstance. Small business and individuals often times looking to make big money, are the victims of scams when it comes to learning about FOREX and the foreign trade markets. As FOREX is seen as how to make a quick buck or two, people don't question their participation in such an event, but if you are not investing money through a broker in the FOREX market, you could easily end up losing everything that you have invested in the transaction

Looking For Forex Markets Worldwide

Forex is a form of buying and selling that also goes as FX or foreign market exchange. Businesses and individuals dealing in FX are more often than not the most wealthy business enterprises and financial firms from all across the globe. Their dealings include multiple currencies from several countries to produce a balance as some are going to gain money and those who fall down. The basic principles of forex are similar to that of most countries, only with a much wider scope. It involves people, money and excThe rates of currency are constantly shifting so what the value of the dollar may be one day could be shifted the next. Trading on the forex exchange can be risky so you have to keep a watchful eye on your money, particularly if you’ve got a lot riding on it, there is a chance you could lose it all. The prime hubs for forex trading are in Tokyo in New Your and in London as well as several other points around the world.

The heaviest amounts of money traded include the Swiss franc, the Australian dollar, the British pound, the United States dollar, the Eurozone euro and the Japanese yen. Mixing and matching currencies is fine as well as mixing the trades between currencies to build up additional money and interest daily.

The areas where forex trading is taking place will open dependent on time zone and then close while other markets are opening. The same thing is common between global stock exchanges as some time zones are actioning transactions and ending in others. The conditions of forex trades in one region could have results and differences in what happens in additional forex markets as nations run on alternate time zones. The exchange rates will be varied between forex exchanges, and if you are a broker, or if you are learning about the forex markets you want to know the rate changes for each new day before committing money.

The stock exchange is primarily measured on various products and their value as well as other financial factors that will shift the share values at any time. When people find out a business event is going to happen before public disclosure, it is considered inside trading, utilizing secret information to buy stocks and make money - which by the way is illegal. There isn’t anything like if any at all inside information the forex exchange. Buying and selling of stocks is the root of the forex stock market but very little is based on business secrets, but rather it depends on the state of currencies and economies around the world.

Every currency that is traded on the forex market has a three letter code associated with that currency so there cannot be any confusion regarding the country or money one is making transactions with. The name of the euro is EUR and the US dollar is known as the USD. The GBP is the British pound and the Japanese yen is known as the JPY. If forex trading seems interesting to you and you want to get in touch with a forex brokerage you can locate several brokers online where you can check out the company’s profile and type of forex transactions before putting your money into the forex stock exchangehanges back and forth across the world in roughly any country.

The heaviest amounts of money traded include the Swiss franc, the Australian dollar, the British pound, the United States dollar, the Eurozone euro and the Japanese yen. Mixing and matching currencies is fine as well as mixing the trades between currencies to build up additional money and interest daily.

The areas where forex trading is taking place will open dependent on time zone and then close while other markets are opening. The same thing is common between global stock exchanges as some time zones are actioning transactions and ending in others. The conditions of forex trades in one region could have results and differences in what happens in additional forex markets as nations run on alternate time zones. The exchange rates will be varied between forex exchanges, and if you are a broker, or if you are learning about the forex markets you want to know the rate changes for each new day before committing money.

The stock exchange is primarily measured on various products and their value as well as other financial factors that will shift the share values at any time. When people find out a business event is going to happen before public disclosure, it is considered inside trading, utilizing secret information to buy stocks and make money - which by the way is illegal. There isn’t anything like if any at all inside information the forex exchange. Buying and selling of stocks is the root of the forex stock market but very little is based on business secrets, but rather it depends on the state of currencies and economies around the world.

Every currency that is traded on the forex market has a three letter code associated with that currency so there cannot be any confusion regarding the country or money one is making transactions with. The name of the euro is EUR and the US dollar is known as the USD. The GBP is the British pound and the Japanese yen is known as the JPY. If forex trading seems interesting to you and you want to get in touch with a forex brokerage you can locate several brokers online where you can check out the company’s profile and type of forex transactions before putting your money into the forex stock exchangehanges back and forth across the world in roughly any country.

Using the Line Chart in Foreign Currency Trading

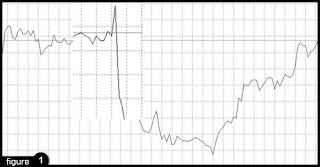

Foreign currency trading line charts are the most basic of the charts used for technical analysis. The line chart is a simple visual representation of data, which plots the closing price of a single day and over the course of weeks and months connects the dots. The following image shows an example of a basic line chart:

Structure Of The Forex Market

First what is Forex: The FOREX or Foreign Exchange market is the largest financial market in the world, with an volume of more than $1.5 trillion daily, dealing in currencies. Unlike other financial markets, the Forex market has no physical location, no central exchange. It operates through an electronic network of banks, corporations and individuals trading one currency for another.The Forex, or foreign currency exchange, is all about money. Money from all over the world is bought, sold and traded. On the Forex, anyone can buy and sell currency and with possibly come out ahead in the end. When dealing with the foreign currency exchange, it is possible to buy the currency of one country, sell it and make a profit. For example, a broker might buy a Japanese yen when the yen to dollar ratio increases, then sell the yens and buy back American dollars for a profit.In the beginning countries would trade with each other using the barter system. If one nation needed lumber but had cattle, they would trade one product for another. This was pure trading. This type of economy has many limitations, but served mankind well for many centuries. However, nations quickly saw the benefit of having a system of exchange, and while some cultures used pretty rocks, or animal teeth, precious metals quickly became established methods of exchange. God and silver were the most popular. Initially gold and silver coins were used, and in fact the name of the British standard currency, the pound sterling, came from the Hasterling region where gold coins were made, and originally meant coins of the Hasterling’s. Up until World War I most nations had central banks that supported the value of their currencies and most used gold as the standard. Paper money was printed and it legally could be exchanged for gold but this did not often happen. Since it was rarely converted, some banks and some nations believed they no longer needed to keep reserves of gold in their vaults, as the US once did with Fort Knox. Inflation then occurred.Near the end of World War II a conference known as Bretton woods had many nations reach an agreement on a reserve currency system based on the US dollar. The World Bank and other organizations agreed, and a fixed exchange rate system was reached. The value of the dollar was fixed on a certain amount of gold, and other currencies were fixed on value to the dollar. Currency trading after this however has evolved and currencies have grown in value, and gone down in value, leading to fluctuation.Today traders take advantage of the fluctuation in value among currencies through the forex or foreign currency markets. It is quite common to see a trader who suspects that the value of the Euro will go up against the yen or the dollar and follow the old axiom of “buy low and sell high.” On of the ways this is done is through margin trading. With margin trading a trader doesn’t have to have all the money in an account that is being traded. If a trader has 10,000 and works with a one percent margin, he is able to trade $100,000 in currency. This adds great leverage to the trade and makes forex trading very attractive to many who are looking for a large and quick return on their investments. Forex traders are also attracted to the low costs associated with trading since most trades are without commission. The fact that there is a 24 hour trading cycle is also attractive to many. Traders have opportunities for large profit, but they also have risk inherent. An aggressive trader may experience profit and loss swings of up to 30% in a day. This can be 30% to the good, or to the bad, so forex trading requires education and courage as well as capital. However there are no daily limits and no restrictions on trading hours other than the weekend when markets are closed. For this reason there are always opportunities. Money will always be made.Some nations in the past have complained about hedge funds and other large institutions involved in forex trading, saying that they have intentionally devalued their currencies to make quick profits. George Soros, the famous billionaire who is involved in politics, has been accused of this practice by the government of Indonesia. Whether it is true or not, and if true whether it should or should not be done is not for this article. However, when institutions control such large amounts of money, the chance of manipulation does exist. As long as foreign currency is traded, there will be such accusations. However, the forex market remains a way to achieve substantial financial gain.

How to make money in stocks and forex trading?

I have been doing Forex Trading for the past 3 years and making a lot of money from it. I’ve tried a lot of forex softwares and e-books but they were very bad and it didn’t help me much but the last two that i have tried and still running them are:

Forex-Killer

Doubling Stocks

I’m running these two upfront and making a lot of money from them. Here is a short breakdown of each software.

Forex-Killer

Doubling Stocks

I’m running these two upfront and making a lot of money from them. Here is a short breakdown of each software.

Forex Trading Medium Term Strategy

Medium-term positions are typically held for periods ranginganywhere from a few minutes to a few hours, but usually notmuch longer than a day. Just as with short-term trading, thekey distinction for medium-term forex trading is not the lengthof time the position is open, but the amount of pips you’reseeking/risking.Where short-term forex trading looks to profit from the routinenoise of minor price fluctuations, almost without regard forthe overall direction of the market, medium-term tradingseeks to get the overall direction right and profit from moresignificant currency rate moves.

Almost as many currency speculators fall into the mediumtermcategory (sometimes referred to as momentum tradingand swing trading) as fall into the short-term trading category.Medium-term trading requires many of the same skills asshort-term trading, especially when it comes to entering/exiting positions, but it also demands a broader perspective,greater analytical effort, and a lot more patience.

Capturing forex intraday price moves for maximum effectThe essence of medium-term trading is determining where acurrency pair is likely to go over the next several hours ordays and constructing a trading strategy to exploit that view.Medium-term traders typically pursue one of the followingoverall approaches, with plenty of room to combine strategies:

1> Trading a view: Having a fundamental-based opinion onwhich way a forex currency pair is likely to move. View tradesare typically based on prevailing market themes, likeinterest rate expectations or economic growth trends.View traders still need to be aware of technical levels aspart of an overall trading plan.

2> Trading the technicals: Basing your market outlook onchart patterns, trend lines, support and resistance levels,and momentum studies. Technical traders typically spota trade opportunity on their charts, but they still need tobe aware of fundamental events, because they’re the catalystsfor many breaks of technical levels.

3> Trading events and data: Basing positions on expectedoutcomes of events, like a central bank rate decision or aG7 meeting, or individual data reports. Event/data traderstypically open positions well in advance of events andclose them when the outcome is known.

4> Trading with the flow: Forex trading based on overall marketdirection (trend) or information of major buying and selling(flows). To trade on flow information, look for a brokerthat offers market flow commentary. Flow traders tend to stay out of shorttermrange-bound markets and jump in only when amarket move is under way.

Almost as many currency speculators fall into the mediumtermcategory (sometimes referred to as momentum tradingand swing trading) as fall into the short-term trading category.Medium-term trading requires many of the same skills asshort-term trading, especially when it comes to entering/exiting positions, but it also demands a broader perspective,greater analytical effort, and a lot more patience.

Capturing forex intraday price moves for maximum effectThe essence of medium-term trading is determining where acurrency pair is likely to go over the next several hours ordays and constructing a trading strategy to exploit that view.Medium-term traders typically pursue one of the followingoverall approaches, with plenty of room to combine strategies:

1> Trading a view: Having a fundamental-based opinion onwhich way a forex currency pair is likely to move. View tradesare typically based on prevailing market themes, likeinterest rate expectations or economic growth trends.View traders still need to be aware of technical levels aspart of an overall trading plan.

2> Trading the technicals: Basing your market outlook onchart patterns, trend lines, support and resistance levels,and momentum studies. Technical traders typically spota trade opportunity on their charts, but they still need tobe aware of fundamental events, because they’re the catalystsfor many breaks of technical levels.

3> Trading events and data: Basing positions on expectedoutcomes of events, like a central bank rate decision or aG7 meeting, or individual data reports. Event/data traderstypically open positions well in advance of events andclose them when the outcome is known.

4> Trading with the flow: Forex trading based on overall marketdirection (trend) or information of major buying and selling(flows). To trade on flow information, look for a brokerthat offers market flow commentary. Flow traders tend to stay out of shorttermrange-bound markets and jump in only when amarket move is under way.